The 10-year Treasury note yield rocketed back above 2% on Friday after the government’s monthly jobs report showed much stronger-than-expected employment growth in June than anticipated.

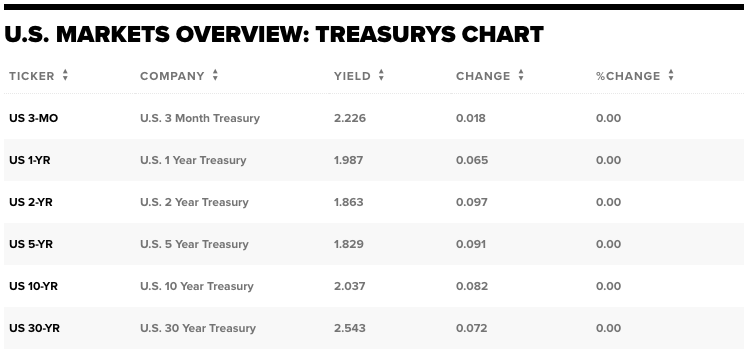

The yield on the benchmark 10-year Treasury note rose 11 basis points to trade at 2.055% following the Labor Department’s release, while the yield on the 30-year Treasury bond climbed to 2.556%. The 2-year Treasury yield, more sensitive to changes in Federal Reserve policy, soared 12 basis points to 1.875%. Bond yields move inversely to prices.

Payroll growth rebounded sharply in June as the U.S. economy added 224,000 jobs, countering recent worries that the employment picture and overall growth picture are weakening. Economists polled by Dow Jones had expected the U.S. economy to add 165,000 jobs in June after May’s initial anemic print of 75,000. The unemployment rate edged up to 3.7%.

The closely watched average hourly earnings number fell short, rising 0.2% on a monthly basis versus 0.3% growth expected. Over the past 12 months, wages were up 3.1%.

Given the relative strength in the latest jobs print, policymakers at the Federal Reserve may see that as further evidence that an interest rate cut isn’t needed to keep U.S. economic expansion alive. The central bank opened the door to easier monetary policy last month by stating it will “act as appropriate” to maintain the current economic expansion.

“The employment report exceeded expectations and casts some doubt on last month’s weak report,” Arthur Bass, managing director of fixed income financing, futures, and rates at Wedbush Securities, said in an email.

“Even with the strong number, markets are still pricing 100% probability of a 25bp ease at the July FOMC meeting, but that is down from 120% probability priced in Wednesday,” he continued.

While some Fed members have indicated that they’d be open to a rate cut later this year, others have stressed the importance of remaining data-dependent and gathering more economic evidence before tinkering with borrowing costs.

“It should be noted that every Treasury issue through the 10yr now yields less than the fed funds rate, so there will be some market disappointment if the Fed does not ease at the July 31 meeting,” Bass added. “My view is the Fed will acquiesce to market pricing and ease 25bp in July, unless there is an upside surprise in the inflation data.”

Markets were closed July 4 in observance of U.S. Independence Day.

Bond yields in major economies worldwide have been flirting with all-time lows in the last few days, a phenomenon some economists think reflects mounting expectations for a global slowdown in economic growth.

The yield on the benchmark 10-year Treasury note fell to its lowest level since November 2016 earlier this week, continuing its slide below 2% on expectations central banks around the world would respond to a slowing global economy with more monetary stimulus.