Stocks fell on Friday as Wall Street concluded a wild week amid trade war fears and worries over the global economy.

The Dow Jones Industrial Average closed 90.75 points lower, or 0.3% at 26,287.44. The S&P 500 dipped 0.7% to 2,918.65 while the Nasdaq Composite pulled back 1% to 7,959.14.

President Donald Trump told reporters on Friday the U.S. is not ready to strike a trade deal with China. “China wants to do something, but I’m not doing anything yet,” Trump said. “Twenty-five years of abuse. I’m not ready so fast.”

Chris Gaffney, president of world markets at TIAA Bank, said Trump is digging in on the U.S.-China trade war. “He believes the trade war impacts China much more than the U.S. In his mind, you can close up the U.S. economy,” he said. “At the same time, you’ve got China doing the same thing.”

“The reactions in the markets this week are maybe more of a realization that this trade war is not going to come to a quick end,” Gaffney said.

Trump also said the U.S. will not do business with Huawei. However, stocks came off their lows after Fox Business reported the White House clarified Trump’s statements on Huawei, highlighting it is only the U.S. government that is not buying Huawei products. CNBC’s Ylan Mui confirmed the clarification.

Chipmakers Micron Technology and Skyworks Solutions both closed more than 2.5% lower.

This comes after China decided to stop buying American crops and after the U.S. officially declared China a currency manipulator earlier this week. The U.S. designation came after China let its currency, the yuan, fall to its lowest level in a decade relative to the dollar, sparking the biggest sell-off of 2019 for stocks.

“If there was any doubt, President Trump has clearly moved from trade wars to currency wars,” said Harvinder Kalirai, chief fixed income and FX strategist at Alpine Macro, in a note. He said the Federal Reserve will be pushed towards aggressive easing measures if President Donald Trump keeps pressuring China. “Investors should incorporate intrinsic hedges to ride out market volatility and protect themselves from policy errors.”

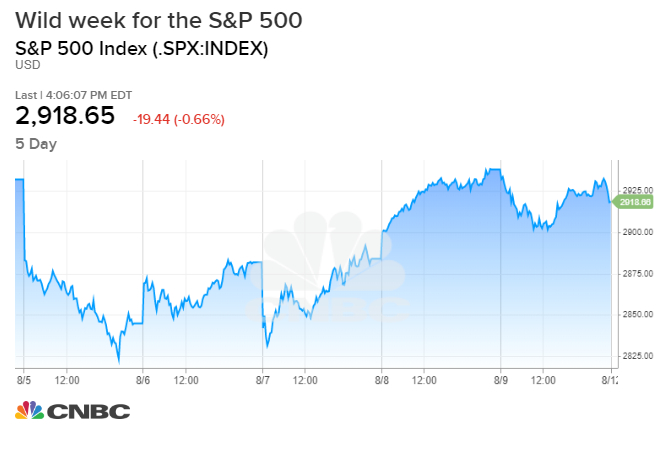

Stocks had a wild week, with the major indexes recording their biggest one-day sell-off of the year on Monday. The indexes recovered some of those losses on Tuesday.

On Wednesday, stocks resumed their sell-off as investors loaded up on traditionally safer government bonds and gold before staging a sharp comeback. By Thursday’s close, the indexes had recovered most of their losses from Monday’s drop.

The Dow ended the week on Friday down 0.75%. The S&P 500 and Nasdaq lost 0.5% and 0.6%, respectively.

Traders also kept a close eye on the bond market, where the recent appetite for U.S. debt has pushed a bond market recession indicator close to a warning zone. If investors trigger a recession warning in the bond market that tends to be negative for stocks.

In Europe, bank stocks led markets lower Friday as Italian lenders tumbled on political uncertainty in the country. Italy’s coalition government imploded on Thursday evening, as deputy prime minister and leader of Italy’s ruling Lega party, Matteo Salvini, declared the arrangement unworkable and called for fresh general elections.