These five investments are great choices for a newcomer who wants to join in on all the fun the stock market has to offer.

Brian Stoffel(TMFCheesehead)Jan 15, 2019 at 2:45AM

Congratulations! You’re ready to start investing. It might seem like a small step, but decades from now you’ll look back and realize how meaningful this moment is to your financial future.

Dipping your toe into the waters of investing can be a scary process. Which stocks should you buy? How can you be sure you won’t lose money? How do you decide when to sell? We’ll walk you through all the crucial questions you should be asking and show you how to find the answers.

TAKE THE PLUNGE INTO PROFITS. IMAGE SOURCE: GETTY IMAGES.

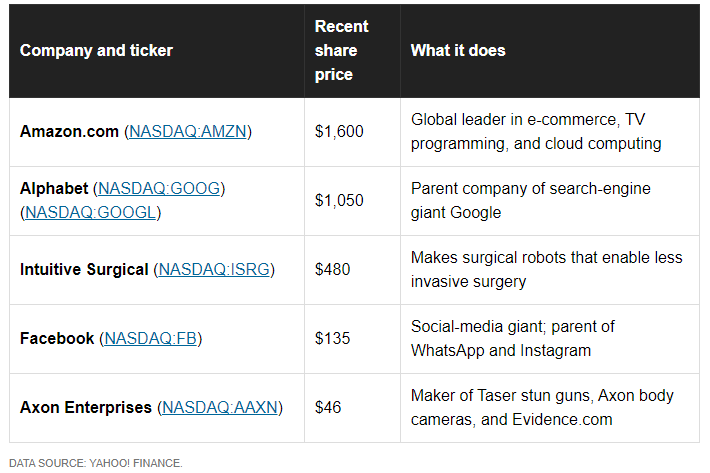

Before we go any further, here are five top stocks for beginner investors in 2019.

How do I buy my first stock?

Don’t run out and buy these stocks right away. Before selecting your first investment, you must complete the following seven financial steps. These nitty-gritty details are important, not only to protect your hard-earned nest egg, but to become a smart investor.

1. Pay down all high-interest debt

Paying down high-interest debt, if you have it, should be your highest priority. Compound interestis the world’s most powerful force, and when you have high-interest debt, that force is working against you.

Generally speaking, high-interest debt is any liability with an interest rate of 7.5% or higher. Mortgages, student loans, and some auto loans therefore don’t qualify as high-interest debt, unless you have poor credit that makes your loan’s interest rate fall above this threshold.

The most common form of high-interest debt in America is credit card debt. As a nation, we’re nearing $830 billion of such debt, with the average interest rate on credit cards at 17.2%. With interest rates sky high, every passing month digs you deeper in debt.

Consider a $10,000 credit card balance. If you pay off $200 per month, a reasonable minimum, it will take more than seven years to pay off. By the end, you’ll have shelled out an extra $7,700 in interest because your debts were compounding that entire time.

There’s no way for your investing money to eclipse the debt that’s piling up, so tackle your debt first.

2. Set up a robust emergency fund

Once your debt is taken care of, build up your emergency fund. Yes, this is a boring exercise, but it could be your saving grace in the future. Set aside enough cash to cover your family’s basic needs for three to six months without any income.

You never know when a medical emergency, job loss, or natural disaster could strike and you don’t want these surprise circumstances to derail all the financial progress you’ve made. We often think these things will happen to other people but not us. However, the probability we’ll live our entire lives without encountering any major calamities is very small.

3. Get insurance coverage

By the same token as the emergency fund, protect yourself by insuring your most important assets.

Make sure your household has insurance policies in place for:

- Health insurance: Get a policy with an out-of-pocket limit that you’d be able to cover using your emergency fund.

- Homeowners or renters insurance: Depending on your living situation, you need one or the other.

- Auto insurance: You need this if you own or lease a car.

- Disability insurance: This is overlooked for people who don’t have physically demanding jobs. Don’t make this mistake because you want to be covered if something causes you to be unable to work indefinitely.

- Life insurance: This is needed if your family would suffer an immediate and permanent loss of income if you died.

These contingencies aren’t fun to think about, but you don’t want to find yourself in a disastrous situation without a financial safety net. Investing well in the stock market won’t mean much if a tree falls on your house and you can’t afford the needed repairs.

4. Only invest money you don’t need for three to five years

There’s never been a wealth creator like the stock market. A hypothetical $100 invested in the stock market back in 1871 would be worth $39 million today. Of course, $100 was far more money back then and no one would actually be alive to enjoythat money 150 years later. But you get the point.

This introduces an important caveat: While the stock market has always gone up more than down over the long run, it can be extremely volatile in the short run. Since 1871, the stock market averages growth of 9.15% per year, but in only six years has the market’s return even fallenbetween 8% and 11%. Most of the time, it’s all over the place.

DATA SOURCES: MONEYCHIMP AND ROBERT SHILLER. CHART BY AUTHOR. RETURNS INCLUDE DIVIDENDS REINVESTED AND DO NOT ACCOUNT FOR INFLATION.

There’s no telling from one year to the next whether stocks will be up or down, and severe downturns occur. During the Great Recession of 10 years ago, the S&P 500 fell 56% from its highs. If you had money in the stock market that you needed in the next three to five years — to pay for a new house, the birth of a child, or a college tuition bill — you’d have been out of luck.

While the market has always bounced back from such downturns, those recoveries take time. Most milestones in life don’t wait for the market to recover, so don’t keep money in stocks that you’ll need soon. Make your finances more liquid by keeping a sum in cash for spending in the near term.

5. Set up your first investing account

Finally, we’re ready to set up your brokerage account on the website you’ll visit to buy and sell stocks. The Motley Fool can help you find the right brokerage for you.

You have the option to set up different types of accounts. In general, there are tax-advantaged retirement accounts and simple non-tax-advantaged ones. Explore the former first, which are designed to enable retirement saving.

For most people, there are two types of retirement accounts to choose from:

- Traditional IRA (Individual Retirement Account): The money you put into this account is tax-deductible, meaning you won’t pay any taxes on it for the year you contribute. You can invest the money in any stocks, bonds or funds you want, and none of the growth is taxed, either. When the time comes to make withdrawals — after age 59 1/2 — those distributions will be taxed at whatever your income bracket is at the time. If you take any money out early, you’ll pay an additional 10% penalty.

- Roth IRA: In some ways, this is much like a Traditional IRA, because the money you put in grows untaxed, and you can invest it in any stock or fund you like. The money you contribute, however, is not tax-deductible. While that may sound bad, consider that after age 59 1/2, any distributions from a Roth IRA are completely untaxed. At any time you want to remove your principal amount — but not any funds created by its growth — you can do it without paying a tax or penalty.

This year, you are allowed to contribute a total of $6,000 to your IRAs. That $6,000 can be split any way you’d like between a Roth and a Traditional IRA. For instance, you can contribute the maximum by putting $3,000 into each type of account.

If you’re 50 or older, that limit bumps up to $7,000. There are income limits for contributing to these accounts — which you need to know before making your final choice.

If your employer offers a 401(k) match, make sure to take full advantage of it by contributing the maximum amount to that tax-advantaged account.

6. Buy to hold over the long term

If you want to achieve great results, it’s also important to get your mind right before you buy your first stocks. By that, I specifically mean getting ready to adopt what’s called a “buy-to-hold” strategy. In essence, that means when you buy a stock, the plan is to hold it forever — or at least until you reach retirement. While you might not end up doing that, taking this approach will cause you to be more far-sighted in picking stocks.

I’ll cover how you can ensure you take this approach in a minute. But first, it’s important to point out why a buy-to-hold strategy is so crucial.

As you already know, the stock market’s returns are significant. Here’s the funny thing: Over a 30-year time frame ending in 2014, the market returned 11.06% per year. But over the same time frame, the average stock investor experienced just a 3.79% return per year. Where does that enormous difference come from?

Summarizing the findings from an analysis of investor behavior, my colleague Matthew Frankel wrote that the agency conducting the study identified “self-destructive behaviors exhibited by investors that contribute to the dismal performance.” A few of the problems: “[I]nvestors tend to have a herd mentality, copying the behavior of others no matter what the outcome. They also tend to have knee-jerk reactions to news without considering all of the relevant information.”

The bottom line: We imagine a world where emotions have no effect on us. We believe that buying low and selling high is both simple and easy. In reality, dealing with strong emotions is never easy. When the market tanks, the urge to hit the “sell” button is very strong — but such behaviors ruin your returns. Don’t be your own worst enemy by adopting the buy and hold approach of investing. Resist selling off when you’re nervous or the broader market falls, by instead returning to your belief in your original investment thesis, or the reason you bought the stock in the first place.

That’s why virtually every reputable study on building wealth says buying stocks and holding them for the long run is the closest thing to a fool-proof wealth builder the world will ever have.

So make sure that before you buy a stock, you write down (1) why you are buying it, and (2) what would have to happen to make you sell it. If you owned shares of Alphabet (parent company of Google), for instance, it might be scary to read that the company received a multibillion-dollar antitrust fine from the European Union.

Sounds bad, doesn’t it? Well, not if you put it in perspective: Alphabet have more than enough cash to cover the fine. More importantly, when I wrote down my reasons for buying the stock years ago, everything important to me was still there: dominance in search, the ability to turn data into advertising gold, and continued innovation. To me, the fine was a minor speed bump.

But I couldn’t have seen the trees from the forest if I didn’t adopt the buy-to-hold approach and write out my thought process.

7. Select and evaluate stocks for your portfolio

So here we are. You’ve covered all of your bases. You’re debt-free, with a full emergency fund and insurance policies in place, and you’re ready to invest money you don’t need in the near term, using your new brokerage account.

Now: What stocks to buy? This will be a lifelong learning adventure, full of twists and turns. Your own temperament and interests will play a huge role in helping you select stocks — what we’ll cover here is only meant to help get you started.

Buy what you know. To be a successful investor, there’s no need to invest in highly complex companies doing things that only Ph.D.s can decipher. Instead, follow legendary investor Peter Lynch’s maxim to “buy what you know.” There’s nothing wrong with investing only in companies you use yourself.

You probably already know three of the companies I’m suggesting today — Alphabet (Google), Amazon.com, and Facebook. You may not realize it, but your daily experience with each one of these companies is important scuttlebutt — the type of boots-on-the-ground research that’s vital but doesn’t necessarily show up in a financial statement.

Examine the stock’s financial fortitude. Once you’ve identified a stock candidate, check on the strength of its financial standing by evaluating these three variables:

- Amount of cash on hand. I include short- and long-term investments in this calculation.

- Amount of long-term debt it carries.

- Amount of free cash flow — which is cash from operations minus capital expenditures — produced over the past 12 months.

Any company we hold will experience difficult financial times over the long run. The organization’s financial fortitude will help dictate how it responds in such times.

If there’s little cash, lots of debt, and weak free cash flow, the company is in trouble. It will have to narrow its focus to survive tough times. Such a company would have two options to shore up its balance sheet: take on more debt, or offer new shares. The former may only exacerbate a long-term problem, while the latter would make lower the value of your own shares by diluting you. Neither one of those options is appealing.

If, on the other hand, it’s flush with cash and has little debt and strong cash flows, the opposite is true. However, tough times might make such companies stronger: They can acquire rivals or drive them out of business by pricing their services lower to steal market share.

Consider valuation. This is part-art, part-science. There’s no single metric that can really tell you how “cheap” or “expensive” a stock is. For instance, a $1,000 can arguably be considered “cheap,” while a $1 stock might be considered “expensive.” That’s because the actual price of a stock isn’t all that meaningful — in fact, a company can do something called a stock split and change the price of a stock overnight. Instead, there are two sets of variables that are more important to follow: price ratios and growth rates.

Price ratios are descriptive figures that offer investors a look at how much they are getting for the price of the stock:

- The price-to-earnings ratio (P/E): A stock’s price divided by earnings per share, or EPS. Earnings per share simply takes all of the profit a company earns (usually over the previous 12 months) and divides it by the number of shares there are. So if Company A has earned $1 million in profit and has 1 million shares, it would have EPS of $1. If the stock trades for $10, its P/E is 10 (or, 10 divided by 1).

- The price-to-free cash flow ratio (P/FCF): The entire market capitalization of a company divided by its free cash flow. The market capitalization is how valuable an entire company is. Free cash flow is the amount of cash a company has put in the bank from its operations over the past year, minus any capital expenditures (money reinvested in the business like building a new office complex or factory). If Company B has a market capitalization of $10 billion, and free cash flow of $0.5 billion, its P/FCF would be 20 (or 10 divided by 0.5).

- The forward one-year price-to-earnings-growth ratio (PEG): This figure takes the P/E and divides it by the forward earnings growth — or the amount by which analysts expect the company’s EPS to grow. In other words, if a company has a P/E of 20 and is expected to grow earnings by 10% next year, its PEG ratio would be 2 (20 divided by 10). Generally speaking, a PEG ratio of 1.0 is considered “fairly valued.”

For growth rates, its important to learn these terms and evaluate a stock’s potential growth:

- Three-year sales growth: If a company is providing something customers like, this number should easily be more than 10% per year. The higher, the better. Obviously, much larger companies — for example AT&T — will be happy to achieve sales growth of 5% per year. But smaller companies going after a big opportunity should hope for much faster growth. Canada Goose Holdings — for example — is a smaller company that sells outdoor clothing and has grown sales by over 30% per year over the past three years. You can find any of these growth rates by typing in a ticker on Fool.com, and clicking “Earnings/Growth Ratio” on the drop-down menu of that company’s page.

- Three-year earnings-per-share growth: This figure tells us how much a company is growing its income. Sometimes, smaller companies might be reinvesting so much in their company that there’s little growth. That shouldn’t deter you. More mature companies, on the other hand, should have earnings growth to at least match sales growth. In other words, if a big company grows sales by 5%, it should grow earnings by more, which demonstrates it has a long-term competitive advantage and pricing power.

Think about moat, or competitive advantages. Finally, we have what I consider one of the most important and overlooked aspects of investing: figuring out a company’s moat. Companies with wide moats keep customers coming back year after year while holding competition at bay, creating enormous returns for shareholders.

There are four types of moats:

- The network effect: Every additional person using the service makes the service itself more valuable.

- High switching costs: Once a customer starts using a product, the costs of switching to a competitor’s offering — both financial, and in terms of time, energy, and headaches — become so onerous that the customer stays with the original provider.

- Being a low-cost provider: If one company can provide something of equal value to the competition at a lower price, it will get more business.

- Having intangible assets: Intangible assets refer to valuable things the company has that can’t be physically measured, including brand value, intellectual property such as patents, and government-regulated protection.

Now, let’s put together all we’ve learned by evaluating the stocks I’ve suggested for novice investors.

Amazon.com

With its signature cardboard boxes piling up everywhere, Amazon needs no introduction. Here’s how it looks financially:

DATA SOURCE: YCHARTS.

Before Amazon decided to acquire Whole Foods, it had far less debt on its balance sheet. The good news, though, is that the acquisition seems to be going well. Some might be concerned by Amazon’s net cash position (cash minus debt) of just $5 billion, but I’m not worried. The company’s free cash flow is quite strong. And Amazon is famous for playing the uber-long game, forgoing short-term profits in an effort to gain long-term dominance. If a crisis were to hit, all Amazon would have to do is lightly tap on the spending brakes, and its cash and free cash flow numbers would be very healthy.

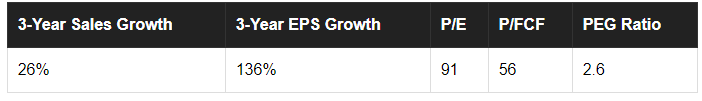

Next, let’s look at valuation.

DATA SOURCES: E*TRADE, YCHARTS

I can’t overstate how impressive Amazon’s sales growth is. The company is already valued at over $700 billion — yet it’s consistently able to post growth rates above 20%. Few companies of this size have been able to accomplish this, historically.

Valuing Amazon is a very difficult task. By almost all the standard metrics, Amazon’s shares are expensive. A PEG ratio of 2.6 means some consider it to be overvalued by as much as 160%. And the company’s impressive EPS growth is a result of minuscule earnings three years ago — resulting from reinvestment at the time.

You’ll never hear me claim that such shares are “cheap,” but if we look at Amazon’s moat, you’ll see why I still think it deserves a place in a beginning investor’s 2019 portfolio.

- Network effect: The millions of people who visit Amazon’s website to buy things every day incentivizes merchants to sell their goods there. As more and more merchants list on the site, more customers are drawn in. It’s a virtuous cycle that’s tough to beat. It also helps explain why Fulfillment by Amazon, its service used by third-party merchants to sell, is thriving.

- High switching costs: This is probably the weakest of Amazon’s moats. For just $119 per year, where else can you get free shipping, access to discounts at the grocery store, and a full media library to view at home — along with a host of other benefits? Perhaps that’s why people sign up, and stay with, Amazon Prime. There are currently over 100 million subscribers, and some think that number could soon hit 275 million. And merchants who have streamlined all of their order fulfillment via Amazon would also be hard-pressed to find a more oft-visited and efficient way to reach customers.

- Low-cost production: This is probably Amazon’s biggest moat. By the best estimates, Amazon has 148 multimillion-dollar fulfillment centers in North America, and another 159 throughout the world. That means Amazon can ship its goods to customers at a lower internal cost than anyone else. In addition, the sheer size of Amazon Web Services allows the company to offer cloud hosting at rock-bottom prices, which help it grab market share.

- Intangible assets:Amazon has a very powerful brand. Forbes pegged it as the world’s fifth most valuable last year, worth about $71 billion.

You’ll notice as we go through the list that no other company has such a wide moat. That’s why I’m comfortable allowing Amazon to occupy roughly 20% of my real-life portfolio and why I think beginner investors shouldn’t worry much about price when it comes to buying Amazon. It will likely pay off in the long run, no matter the price today.

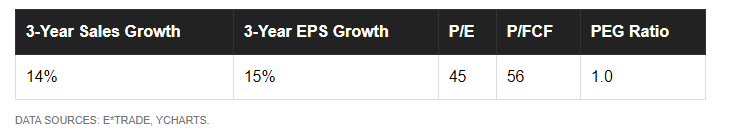

Alphabet

While the name Alphabet might not sound familiar, you know it well: It used to be known as “Google.” Let’s examine the behemoth’s financial fortitude.

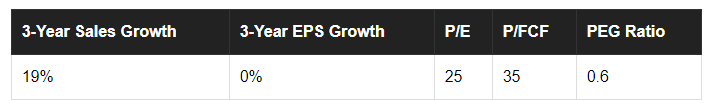

DATA SOURCES: E*TRADE, YCHARTS

At first glance, the 0.6 PEG ratio might make you think Alphabet shares are drastically undervalued. Here’s why: Google suffered a $2.7 billion fine from the European Commission in 2017 that dragged down its earnings. The fine was due to regulators believing that Android developers were forced to pre-install Google search as the default on their phones, since the Android system is run by Google. The fine was one-off in nature and is not a huge problem for the company.

Earnings are expected to grow markedly in the year ahead — but only because the penalty distorted results. That’s why the company’s earnings and free cash flow ratios are more instructive. Using those figures as our compass, it’s fair to say shares of Alphabet are neither “cheap” nor “expensive.” I would argue they’re fairly priced. And for a company with as many moats as Google has, a fair price is nothing to quibble about.

Here’s a look at its moats:

- Low-cost production: It might be easy to forget, but Alphabet makes most of its money — 86% in the most recent quarter — from advertising. And its ads are so valuable because of all the data it collects on users. Google has eight products with more than 1 billion active users: search, Maps, Gmail, Android, Chrome, YouTube, Google Play Store, and Google Drive. Once these services were set up, the company doesn’t pay much in maintenance — but the valuable data it collects continues to increase at a rapid pace.

- Brand value: Google’s brand is the second most valuable in the world, with an estimated value of $132 billion, according to Forbes.

Then there’s Google’s “Moonshot” projects. Most of these projects will fail, but if even one of them “hits,” the results for both the company and everyday folks could be substantial. These projects include self-driving project Waymo, renewable-energy storage company Malta, and several others.

These projects all eat up a lot of research and development (R&D) dollars. But if, as I said, one becomes a big hit, it can not only help recover all those R&D dollars but also add more to the company’s profit.

Since tools such as YouTube and Google search are still the backbone of the company, you can easily keep tabs on Alphabet by monitoring your own behavior. If you find yourself using Bing.com over Google, or searching for videos somewhere other than YouTube, you’ll know it’s time to investigate potential shifts in demand. My reliance on these products has grown over time, so I’m comfortable letting Alphabet occupy 12% of my real-life portfolio — and I think it deserves a spot in yours as well.

Intuitive Surgical

Next we have a company you may not have heard of. Intuitive Surgical is the company behind the da Vinci surgical robot. In the simplest terms, these robots are controlled by a surgeon’s hand movements, making surgeries less invasive. This development means better outcomes, less bleeding, and shorter hospital stays and shorter recoveries.

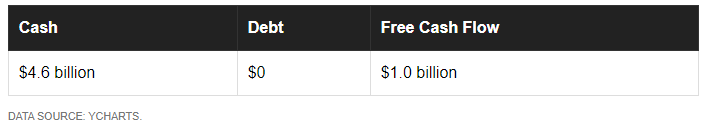

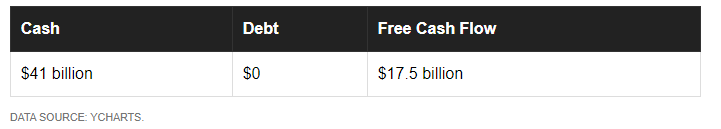

Let’s start out by looking at Intuitive’s balance sheet and cash flow.

I’ve been covering Intuitive Surgical for The Motley Fool for over five years. I can tell you that improvements on the balance sheet have been mammoth. At the end of 2014, the company had $2.5 billion in cash and free cash flow of $560 million and it didn’t take long for these figures to almost double.

That cash pile is going to be important. After years of enjoying market dominance in the entire robotic surgical field, competition is finally on the horizon. Should any of that competition pose a legitimate threat to Intuitive, it has the resources to partner with the market entrant or even acquire a competitor outright.

Next, let’s look at how much shares cost.

These shares aren’t “cheap.” Even though procedures using the da Vinci have boomed in recent years, the company has been investing aggressively in its platform. It wants to hold competition at bay, but also create machines that make surgery as safe as possible. Those investments hold down earnings growth and mean the company’s ratios are elevated.

That said, buying shares of Intuitive also gives you ownership in a company with a huge moat:

- High switching costs: The hospitals that buy da Vincis fork over about $1.5 million per machine. The doctors who perform surgeries with them spend a lifetime training on the platform. With more than 4,400 machines installed globally and 43,000 doctors trained on da Vinci, there would be a materially high cost in switching.

- Network effect: Just as important, that huge network of hospitals and doctors makes the da Vinci system even more valuable over time. That’s because doctors, in collaboration with Intuitive, tinker with the machine to try it out on more procedures. Case in point: Five years ago, hernia operations weren’t even on Intuitive investors’ radars. Today, they’re the key growth driver for the company. More doctors means more tinkering, which — over a long enough time frame — means more procedures da Vinci can improve. Finding new uses for existing medical devices is a vital way for companies like Intuitive Surgical to grow.

This company will be tougher to follow for the beginning investor — as you likely don’t undergo or perform surgeries on a daily basis, and the company isn’t often talked-about in the news. But procedure growth is the metric to focus on:

DATA SOURCE: SEC FILINGS. CHART BY AUTHOR.

I don’t expect procedure growth to stay this high forever, but as long as it remains over 10%, there’s incentive to own shares of Intuitive Surgical.

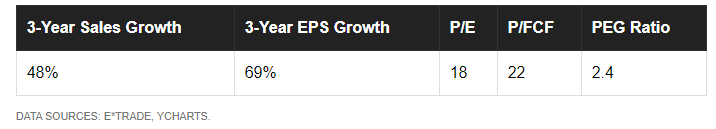

Here again we have a company you’re probably very familiar with. Facebook not only runs its eponymous website, but it also owns Instagram, WhatsApp, and a virtual-reality division called Oculus.

Let’s start by investigating the company’s financial fortitude.

As with Alphabet, this is one of the strongest balance sheets and cash flow figures you’ll find in the world today. Facebook, like Google, is primarily an advertising company, and it’s clear from the cash flow statement that it has no trouble selling ads.

The company’s cash position — with absolutely no long-term debt — puts it in a unique position. In contrast to Alphabet, though, this cash position comes with a catch. Facebook has endured material scandals lately, highlighted by the Cambridge Analytica fiasco in 2016. The incident highlighted how outside forces can use Facebook to gather data about users without the user’s knowledge.

It’s unlikely the government would allow Facebook to make any more huge social-media acquisitions. That being said, the company can use its capital to buy back stock at a discount or enter new lines of business.

Next, let’s look at the company’s valuation:

The company said it will spend more on security and site enhancement, so don’t expect the earnings growth to stay anywhere close to what it was over the past year. That’s the reason the PEG ratio is so high, even though both the earnings (P/E) and free cash flow (P/FCF) ratios are reasonable. Earnings are expected to be flat, or unchanged, in 2019.

It’s not all bad news for shareholders. The past two years have taught us that social-media companies must begin taking security and privacy seriously. Data is valuable and there are many nefarious players aiming to get their hands on it.

While that means Facebook will have to spend more, it means the costs of providing that security will be prohibitively expensive for any future competitors. We can expect the barriers to entry in the social media sector to rise, keeping would-be competirors at bay and stemming the tide of data-driven start-ups that have been swelling over the past decade.

And that brings us to the strength of Facebook’s moat.

- Brand: Forbes estimated last year that Facebook had the world’s fourth most valuable brand, valued at roughly $95 billion. I wouldn’t be surprised, however, to see this figure fall, given all of the bad publicity of the past year.

- Network effect: No company is a more textbook example of the network effect than Facebook. There’s no point in joining a social network if your friends, family, and colleagues aren’t a part of it. Last quarter, Facebook’s monthly active users grew 10% to 2.3 billion people — or over one-quarter of Earth’s inhabitants.

- High switching costs: This is a relatively underappreciated moat for Facebook. But advertisers that want access to both Facebook and Instagram can easily handle all of their accounts on a single interface. It would be tough to get as many eyeballs, in such a centralized platform, as Facebook manages to do.

In the end, you’ll know well if Facebook is in trouble. It’ll be if you — or your kids or grandkids — stop using Facebook and Instagram and WhatsApp over time. That would be a sign you should reevaluate your investment.

If you want cold, hard numbers, keep an eye on monthly active users, a great barometer for how the company’s long-term prospects are faring. Remember, as Facebook captures more and more of the world’s internet users, growth will slow. But anything above 7% growth through the next three years would be a stellar accomplishment.

Axon Enterprises

Finally, there’s little-known Axon Enterprises. It used to be known as TASER International, which provides its eponymous stun guns to police forces all over the world. The company changed its name in early 2017 to highlight its focus on body cameras and on Evidence.com — its software-as-a-service storage system that analyzes the footage.

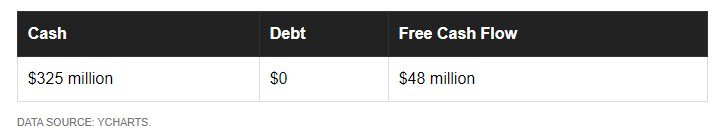

First, we’ll investigate its financial fortitude.

As you can probably tell, Axon is much smaller than the rest of the companies on this list. While Alphabet is valued at about $750 billion, Axon’s market cap is just $3 billion. That said, the company’s cash pile, lack of debt, and recent reemergence as a free cash flow-positive company are all very important.

To entice police departments into using Axon cameras, the company actually gave them away. Axon’s real money is made on Evidence.com subscriptions. Giving away product is not cheap and neither was developing the Evidence.com platform, so Axon was not profitable for a spell, but that time has passed.

Next, let’s look at valuation.

There’s no way around it: Axon is expensive. When these ratios (P/E and P/FCF) are as high as they are here, investors need to be sure they know there’s growth coming down the road. But it’s important to understand all of the moving parts.

The largest division is Axon’s TASER weapons. The tasers are a mature product, so growth rates are much slower. If we look at body cameras and Evidence.com, however, we see growth has been much more brisk.

DATA SOURCE: SEC FILINGS. CHART BY AUTHOR. ALL FIGURES ROUNDED TO NEAREST MILLION. TTM = TRAILING 12 MONTHS.

While the weapons segment has shown modest growth, Axon camera sales have grown an average of 48% per year since 2014, while Evidence.com has grown even faster, at 124% per year.

That’s why I think beginner investors shouldn’t be bothered too much by the hefty price tag.

Finally, let’s look at Axon’s wide and growing moat:

- Brand: TASERs have a virtual monopoly. They’re the only real stun gun available at scale to police forces. With the 2018 acquisition of Vievu, the same can be said for Axon’s body-camera business.

- Network effect: The ability of Evidence.com to analyze police video relies on artificial intelligence (AI). The more police departments loading footage on Evidence.com, the more the AI can learn. As more departments sign up, the better the AI gets. The same can be said for the company’s newest product, Axon Records, which will roll out in late 2019.

- High switching costs: This is probably the most important for Axon. As departments load more video onto Evidence.com, and officers become more familiar with the interface, the switching costs for migrating to another provider become onerous. The costs, headaches of retraining forces, and threat of losing critical legal data will keep departments tied to Axon for the long haul.

With Axon, it might be a little more difficult to keep tabs on how the company is doing — as opposed to the everyday companies you interact with like Facebook, Alphabet, and Amazon. I suggest following two developments: the number of Evidence.com seats booked in a quarter, which represents the number of new officers using the platform, as well as the results from the Axon Records rollout in the second half of the year.

Slow and steady investment wins

I want to share a final thought about how to go about buying shares of these companies. I believe the best way for investors to dip their toes in the market waters is to do so slowly.

There’s no need to invest everything you have in these five companies all at once. Ideally, you’ll build out a portfolio of at least 15 companies. Take the money you might devote to any one of these, and only use a third of that money to buy shares. By doing so, you put your skin in the game, but you also give yourself time to get more familiar with them before devoting more of your hard-earned cash to their futures.

Perhaps a solid approach would be to wait six months. Over that time frame, the company should have at least two more quarterly reports that you can read about. If your reasons for investing are even stronger, you can add a second helping of shares.

And as you get more familiar with the stocks you own, you’ll no doubt encounter other stocks you might be interested in. I highly suggest sticking with stocks you fully understand, and easing into them the same way you will with these five. It limits the chances of making a rash decision that ends with losing money.

In the end, I’m a big believer in all five of these companies — they comprise over 50% of my real-life holdings. While you don’t need to devote that much, putting shares of these companies in your portfolio today will help secure your family’s financial future far beyond 2019.

Should Amazon be on your buy list? It’s on ours…

Motley Fool co-founders Tom and David Gardner have spent more than a decade beating the market. In fact, the newsletter they run, Motley Fool Stock Advisor, has tripled the S&P!*

Tom and David just revealed their ten top stock picks for investors to buy right now. Amazon made the list — but there are 9 other stocks you may be overlooking.